What Are The Benefits of A Universal Life Insurance Policy? By doing so, you can be confident that you are making an informed decision and securing your financial future.

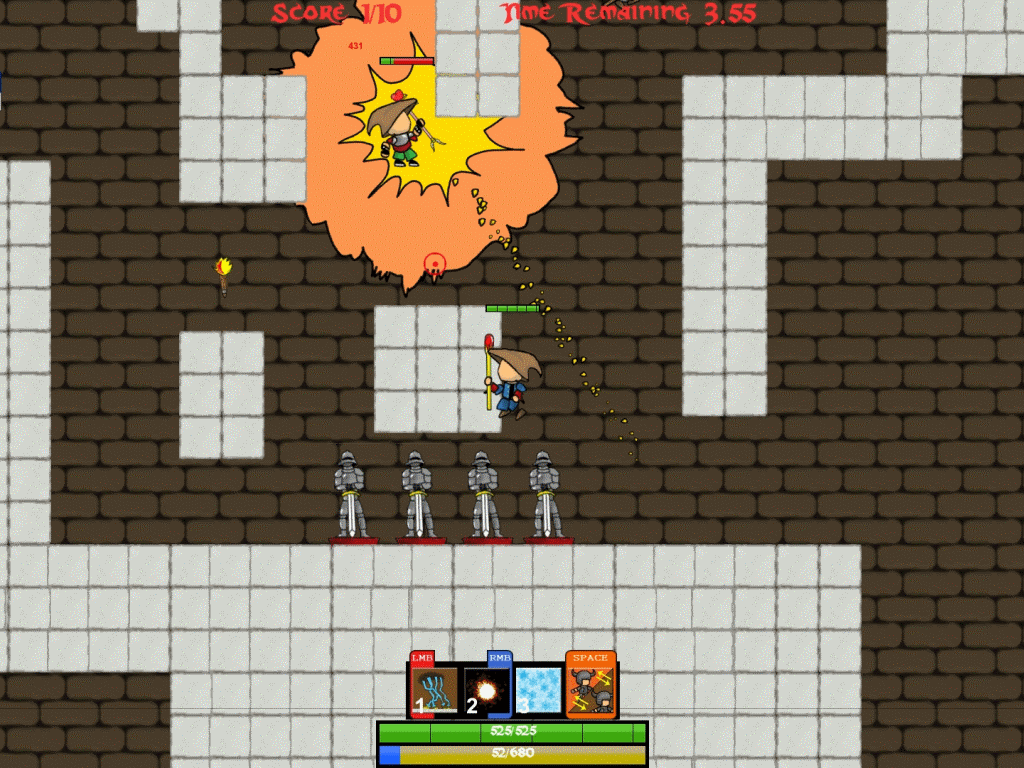

DEMON BOY V0.32 PROFESSIONAL

However, it is important to work with an experienced insurance professional to determine if it is the best option for your unique situation. With its flexible premiums, investment options, and additional riders, it can be a great option for those looking for more control. Universal life insurance offers comprehensive coverage for both your loved ones and your investment future. Additionally, the death benefit is generally tax-free for your beneficiaries, providing some peace of mind during a difficult time. The investment component of the policy grows tax-deferred, meaning you do not pay taxes on the growth until you withdraw the funds. Tax Benefits: Finally, it's worth mentioning the tax benefits of universal life insurance policies.Other riders may include long-term care coverage or a waiver of premium rider, which allows you to stop making premium payments if you become disabled. These riders can include accelerated death benefits, which allow you to access a portion of the death benefit if you are diagnosed with a terminal illness. Additional Riders: Universal life insurance policies often offer additional riders that can enhance your coverage.Additionally, you have control over how your investment component is allocated, allowing you to adjust based on market conditions. For example, you may choose to increase your coverage as you start a family or decrease it as you approach retirement. Policyholders can adjust their premiums and coverage levels as their needs change. Flexibility: One of the biggest advantages of universal life insurance is its flexibility.However, it's important to note that any withdrawals or loans against the policy may reduce the death benefit amount. This cash value can be used to pay your premiums or taken as a cash withdrawal if needed. A portion of your premium payments is invested, typically in stocks or bonds, helping to grow the cash value of your policy over time. Investment Component: Another unique feature of universal life insurance policies is the investment component.Depending on the policy, the death benefit may be paid out in a lump sum or as regular monthly payments. The death benefit amount can vary depending on the policy and the individual's needs but generally ranges from $25,000 to $5 million or more. Death Benefit Coverage: The primary purpose of any life insurance policy, including a universal life insurance policy, is to provide a death benefit to your beneficiaries in the event of your passing.

Here, we will discuss what universal life insurance covers and help you determine if it is the right option for you. If you are considering purchasing a universal life insurance policy, you may be wondering what exactly it covers.

This type of insurance offers both a death benefit and an investment component, making it an attractive option for many individuals. One of these options is universal life insurance. When it comes to purchasing life insurance, there are a lot of options available to choose from. What Does Universal Life Insurance Cover? In this article, we explore what makes universal life insurance unique so that you have all the information necessary to decide if it’s right for you and your family! 1. Universal Life Insurance is an interesting solution because it combines features of both permanent and term life policies. What Is Universal Life Insurance?ĭo you ever feel like life throws unexpected curveballs at you that can threaten your financial security? Insurance is one of the best ways to protect yourself and those you love from life’s uncertainties, but selecting the right kind of insurance coverage can be confusing. Once you share the links with potential visitors, you get paid for each visit to your links based on our payout rates, and you can withdraw your earnings immediately once you reach the minimum withdrawal amount.

0 kommentar(er)

0 kommentar(er)